Employee 401k match calculator

Step 6 Determine whether an employer is contributing to match the individuals contributionThat figure plus the value in step 1 will be the total contribution in the 401k Contribution account. Access affordable 401k plans for small businesses with QuickBooks Payroll.

Doing The Math On Your 401 K Match Sep 29 2000

Engage Employees and Encourage Them to Save With a 401k Match This Year.

. During this time the employee must have completed at least 30 years of creditable service. Employer Match Explained. The employer match is an excellent incentive tool to encourage employees to participate in your small business 401k plan.

The employer can match 100 of the first 4 of employee contributions. Only 6 of companies that offer 401ks dont make some sort of employer contribution. Sometimes theyll choose to contribute only a certain percentage of how much you contribute to your 401k.

Explore other employee services you can get. The match what you put in up to 5 When you leave the company theres a 30 day restriction until you can touch it. A 401k is an employer-sponsored retirement plan.

Step 5 Determine whether the contributions are made at the start or the end of the period. 401k Employer Match Calculator Many employees are not taking full advantage of their employers matching contributions. What does 6 401k match means.

Medical dental vision basic and supplemental life insurance short and long-term disability and 401k with up to 5 company match. If you earn 50000 and you add your 5 to the plan thats 2500 youve put in. In addition many employers will match a portion of your contributions so participation in your employers 401k is like giving yourself a raise and a tax break at the same time.

A 401k is a retirement savings and investing plan that employers offer. Matching Contributions for a Roth 401k. Attract talent and match contributions so your team can grow with you.

Affordable 401k plans by Guideline fit your budget and free up your cash. Dollar-for-dollar match up to 5. Participants can contribute as much as 3 of their salary and earn a match of 50.

Pick the best retirement plan for your budget today. The employer-matching funds will belong to you after five years at your job but if you leave your job after three years you will be 60 vested. Please visit our 401K Calculator for more.

The best 401k match would be a 100 match up to the allowable limits. There are a few different ways employers can match an employees 401k contribution. In order to receive a FERS benefit the employee must meet the Minimum Retirement Age MRA of 55 or 57 depending on the year of birth.

An employee who earned 30000 a year would receive a 1500 contribution to their 401k while an employee who made 200000 would get 10000. Step 7 Use the formula discussed above to calculate the maturity amount of the 401k. Employee benefits flexible administration business insurance and retirement plans.

No perks very basic 401k match vesting over 3 years. Only applicable after a year of working or 1000. As part of a 401k plan employers can choose to match employee contributions usually up to a certain percentage of the employees paycheck.

In 2022 individuals can contribute up to 20500 under 50 or 27000 over 50 to their 401k retirement plans. If this employee earned 60000 the employer would contribute a maximum of 1800 to the employees 401k that year. Tax-deferred growth and a possible company match.

Safe Harbor 401k Match. Your company might include a dollar for every dollar you put in your 401k plan until you reach a total of 5 of your before-tax pay for the year. A Safe Harbor 401k allows employers to choose a matching contribution amount ranging from 3-6 of an employees contribution or salary.

So in order to avoid non-discrimination testing the business owner must contribute to the employees accounts. A 401k plan gives employees a tax break on money they contribute. For example an employer may match up to 3 of an employees contribution to their 401k.

Which benefits does Blue Origin provide. Payroll 401k and tax calculators. Inflation the rate at which the general level of prices for goods and services is rising and subsequently purchasing power is falling.

Simple 401k Calculator Terms Definitions 401k a tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code. Provides up to 4 weeks per year in addition to 14 holidays. While the word match can imply they contribute the exact same amount that you do thats often not the case.

Employer 401k contributions are subject to an employee compensation cap of 305000 for 2022. Matching not only helps employees create better. Matches five percent which is pretty good for a part time employee.

But any match is generally considered good since it represents a risk-free return on investment. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. See what happens when you increase your.

Then your employer will match 100also 2500. The IRS allows plans to reach up to 61000 in combined employeremployee contributions. Lets say you have a plan that increases the amount you are vested in your plan each year by 20this is known as graded vestingYou will be fully vested ie.

What Happens if I Leave Before I Am Fully Vested in My 401k. Target 401K Plan reported anonymously by Target employees. The IRS contribution limit increases along with.

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit or 27000 year 2022 limit for those 50 years or older in the first few months of the year then you have probably. A 401k is an employer-sponsored retirement plan that lets you defer taxes until youre retired. This means that the employer is matching up to a total of 6 of an employees overall compensation to his or her 401k account on top of.

What 401K Plan benefit do Target employees get. Contributions are automatically withdrawn from.

Simple Ira Retirement Plan For Small Business Owners Simple Ira Retirement Planning Ira Retirement

Retirement Savings Spreadsheet Spreadsheet Savings Calculator Saving For Retirement

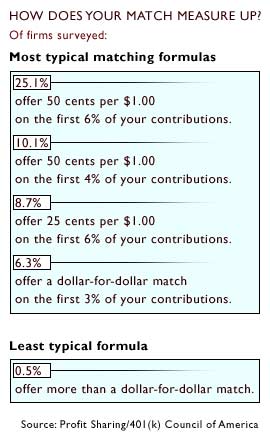

Doing The Math On Your 401 K Match Sep 29 2000

Free 401k Calculator For Excel Calculate Your 401k Savings

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Is Your Company S 5mm 401k Plan Paying More Than 1 25 All In Do You Even Know What You Re Paying We Can Help Https 401kspec 401k Plan How To Plan 401k

What Is A Retirement Plan Retirement Planning How To Plan Investment Advice

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

Customizable 401k Calculator And Retirement Analysis Template

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

401k Contribution Calculator Step By Step Guide With Examples

401k Contribution Limits And Rules 401k Investing Money How To Plan

401 K Plan What Is A 401 K And How Does It Work

Excel Tutorial Simplified Formula Example 401k Match

What Is A 401 K Match Onplane Financial Advisors

Retirement Services 401 K Calculator